Taxes On Social Security Income 2025 Brackets. The federal income tax has seven tax rates in 2025: It's impossible to come up with a single rule that will cover every situation involving income taxes and social security benefits.

Paying Social Security Taxes on Earnings After Full Retirement Age, Calculating taxes on social security benefits

2025 Tax Brackets California Kimberly Underwood, It's impossible to come up with a single rule that will cover every situation involving income taxes and social security benefits.

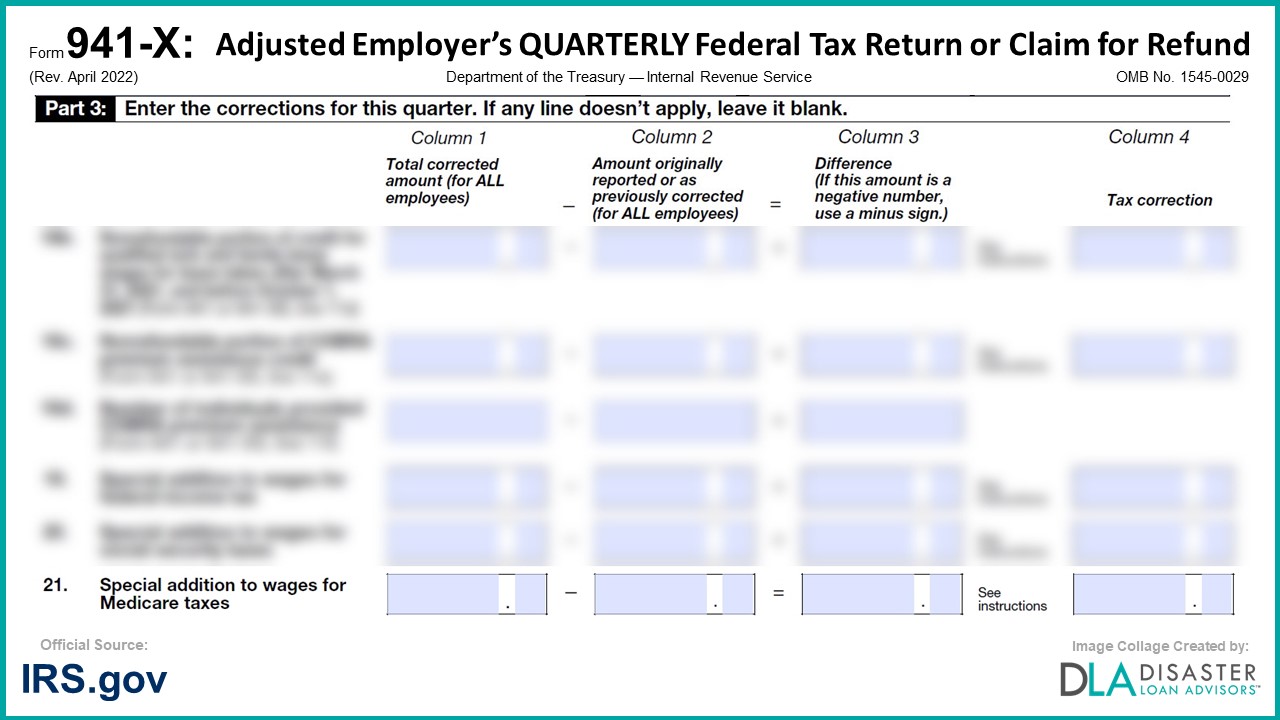

941X 21. Special Additions to Wages for Federal Tax, Social, The social security administration will allow you to withhold taxes directly from your monthly payments.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

2025 Irmaa Brackets Part D Premium Lotte Kendra, Social security tax is distinct from federal income tax withholding.

2025 Irmaa Brackets Social Security 2025 Dorena Darelle, Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

Social Security Tax Limit 2025 Calendar Arturo Levi, In 2025, individual taxable earnings up to $176,100 will be subject to social security tax, according to an announcement by the social security administration (ssa) on thursday.

Social Security Tax Limit 2025 Calendar Joaquin Theo, Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

2025 State Corporate Tax Rates & Brackets, Employers are obligated to deduct tax at source from an employee’s salary.

Social Security Tax Limit 2025 Calendar Arturo Levi, Irs unveils capital gains tax thresholds for 2025;